Image by Toa Heftiba via Unsplash.com

This is an exciting post for me to write, since my April budget was really fun to make. It’s been a work in progress since I wrote about it in my post What Will My Life Look Like #debtfree? and now it looks entirely different, with changes in both income, savings, and spending categories. Let’s check it out.

As you can see, my income from my job is the same as usual. The difference here is that my father is no longer gifting me $100 each month. Personally, I’m just grateful he was able and willing to support me for as long as he did, and now that I don’t have debt, I have no qualms at all about my parents having this money instead of me each month.

My car and gift funds are remaining the same. I’m increasing my Iceland fund in order to stack more cash before the trip comes up, decreasing my summer payment savings since I decided to work this summer, and decreasing my Emergency Fund savings because I’m prioritizing taking a trip over Spring Break. More on this later.

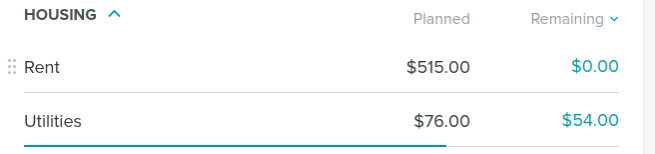

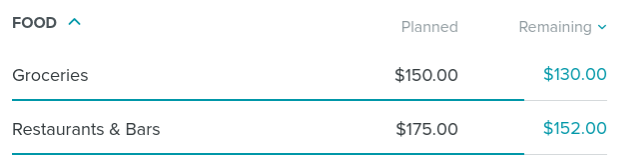

As you can see, my housing, transportation, and insurance are the same as always this month.

I increased my grocery fund in order to focus on healthy eating over my budget (something I have arguably been neglecting), and increased my going out fund, something I value highly.

I increased my miscellaneous fund to give myself more wiggle room in case anything comes up. My subscriptions increased because I added a $3 Patreon subscription to the Minimalists podcast.

You’ll notice I am putting aside $350 this month for something called a Pakt One. It’s basically a super nice travel bag that I decided to spend this crazy (to me) amount of money on. I have literally never thought about spending this much money on something like a fancy carry on, but I have been considering making this purchase post-debt, and I feel good about it for a number of reasons. Plus, my only other carry-on (my backpack) has a giant hole in the bottom that I did a subpar job of sewing up. So, I’m splurging.

I’m also putting $350 aside to cash flow a camping trip over Spring Break this year, something I have no hesitation about, unlike buying a $350 bag…

Here are the totals. Even with losing $100 per month and objectively spoiling myself a lot this month, I’m still saving 34% of my income. That’s the beauty of being completely debt free. This is no where near where I’m aiming to be each month, but it’s what my April is going to look like, and I’m actually really okay with that.

eeeeeeee

LikeLike

Congratulations on being debt-free! You deserve it. I just found your blog and I’m loving following your journey.

I was very lucky to be able to graduate (twice) debt-free, and only today I see how privileged I am. But at the same time, I feel that I could have some money saved by now (I have none). Well, I think the first step is learning, so here I am. =)

LikeLike